Feb-2023

Canadian Venture Capital-Funded Biotech Companies to Watch in 2023

This article was originally published by Back Bay Life Science Advisors on February 1, 2023.

Canada’s thriving life science economy: spanning biotechnology/pharmaceuticals, medical devices, and digital health, consists of around 6,000 organizations and employs 120,000 people 1. The biotechnology and pharmaceutical industries comprise more than half of the companies that encompass the Canadian life science industry. The Canadian biotech industry is expected to grow through the next decade and demand an additional 25,000 workers by 2029, particularly in bio-manufacturing and processing.

Sustained growth of the Canadian biotechnology industry will be largely dependent on the continued flow of funding internally from Canadian biotech VCs, as well as US and foreign funds. There has been a total of 89 financings led by Canadian-headquartered VC groups since the start of 2017. Over the last five years, the frequency of Canadian VC-led biotech financings has doubled (Figure 1). That increase is represented across all funding rounds, including pre-Series A (seed and accelerator), early-stage VC (Series A and B), and late-stage VC (Series C+).

While 2022 saw a downturn in funding frequency, likely driven by macroeconomic and uncertainties in the capital markets, VCs have demonstrated a preference for larger deals as deal values have increased sixfold since 2017, with the average deal size in 2022 of ~$31M 2.

A few of the largest Canadian VC-led biotech financings occurred in 2022, including Apnimed’s $62.5M Series C (Sectoral Asset Management), Congruence Therapeutics’ $50M Series A (Amplitude Ventures), and Domain Therapeutics’ $41.7M Series A (CTI Life Science).

Even from 2017 to 2021, where the relative distribution of deals across funding rounds remained fairly stable, the average deal size tripled from $5M to $17M. While the value of later stage deals has stabilized since 2020, pre-Series A and early-stage financings have shown 6x and 4x increase from 2017-2022, respectively (Figure 1C). An influx of financial backing for the biotech industry leveraging the strong scientific track record is likely to accelerate innovation and economic growth in the industry and drive the ability to recruit, develop, and retain a skilled technical workforce to support further the industry, an issue which has encumbered the Canadian biotech industry to date.

FIGURE 1

Figures provided by Back Bay Life Science Advisors

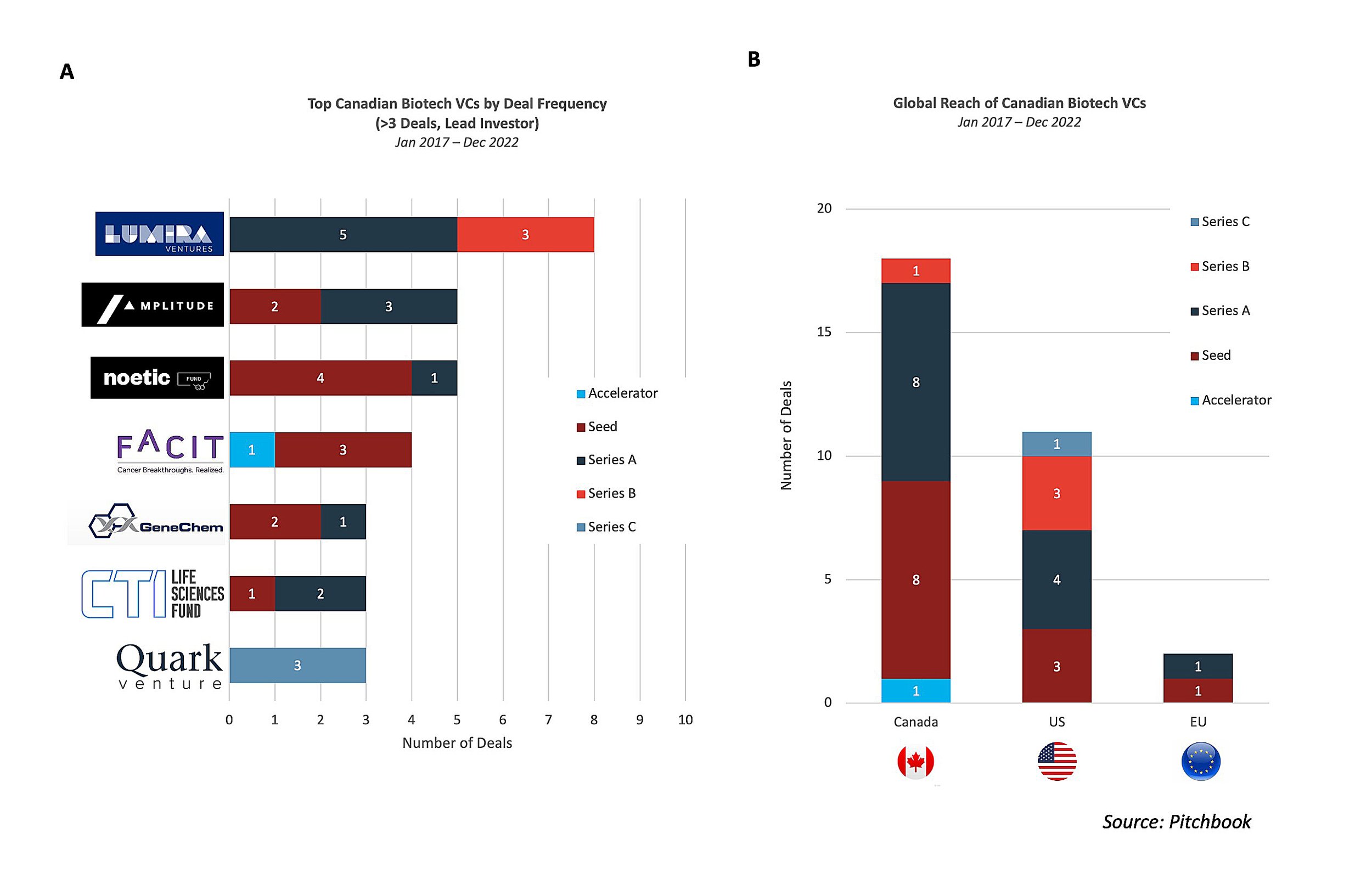

Lumira Ventures and Amplitude Lead the Way for Supporting Canadian Biotech

Seven Canadian biotech VCs have led financings rounds for at least three deals since 2017 with Lumira Ventures (8), Amplitude Ventures (5), and Noetic Fund (5) most frequently leading financings (Figure 2A). Around 80% of funding has been for seed or Series A raises and nearly 60% of the funding has gone to Canadian biotechs (Figure 2B)2. Each of the VCs leading at least four deals, aside from Noetic Fund, have directly acted as the sole/lead investor for fundraising rounds for early-stage Canadian biotechs, with FACIT and Amplitude Ventures exclusively funding Canadian biotechs over the last five years. Lumira Ventures has served as the lead investor for both US and Canadian biotech companies (AmacaThera, Cyrano Therapeutics, Edesa Biotech, and KalGene) and has led the most Series B rounds of the VC firms. Amplitude Ventures, along with FACIT and GeneChem, has solely led financing rounds for Canada’s headquartered biotechs. Noetic Fund, coming off a successful exit of Cybin in 2021, selectively funds companies developing CNS therapeutics with a targeted focus on psychedelic compounds for the treatment of psychiatric disorders, as evidenced by portfolio companies, Beckley Psytech, Delix Therapeutics, and Diamond Therapeutics. AdMare BioInnovations has also been actively involved in driving innovation in Canada by co-leading seed funding for Specific Biologics in 2021 and further investing in more than 10 companies since 2017.

US biotech VCs have also been actively involved in Canada, have contributed to the emergence of the strong early-stage ecosystem, and are increasingly looking to put “boots on the ground” growth of companies in Canada. San Francisco Bay Area headquartered Versant Ventures, with a global life science presence, has offices in Toronto and Vancouver and has a track record of investing in homegrown talent.

Versant currently has multiple Canada-based biotechs in its portfolio including Chinook Therapeutics, Foresight, Northern Biologics, Repare Therapeutics, Ventus Therapeutics, and Turnstone Biologics. The success of Turnstone, in particular, demonstrates the value of the rich academic research ecosystem in Canada and its relationship with VCs as the biotech was co-founded by FACIT based on fundamental research led by Dr. John Bell at the University of Ottawa.

FIGURE 2

Figures provided by Back Bay Life Science Advisors

In addition to a thriving private capital ecosystem, Canadian companies have been successful in raising money on the public markets as well. The average market cap of the 251 public biotechnology and pharmaceutical companies listed across Canadian exchanges is $103M USD3. This includes the three largest Canadian biotech IPO raises that occurred in recent years from AbCellera Biologics ($556M, human antibodies), Repare Therapeutics ($253M, oncology therapeutics), and Fusion Pharmaceuticals ($213M, oncology therapeutics).

As acquisition or partnerships are always a potential part of a biotech company’s long-term growth story, there have been a number of high-profile Canadian exits. Notably, Pfizer acquired Ontario headquartered biotech Trillium Therapeutics for $2.3B in 2021, after investing $25M in the company a year prior to further the development of their immune checkpoint inhibitor assets in Phase 1b/2 clinical development for hematological malignancies. In addition, after the third round of funding in January 2020 from Ontario’s WinnerMax Capital, Engage Therapeutics was acquired by Belgium’s UCB for $270M in June 2020, one year prior to the anticipated completion of pivotal Ph3 trials of staccato alprazolam in stereotypical prolonged seizures.

Which biotech companies are anticipating clinical trial results that may lead the way to an IPO or trigger the next big Canadian biotech acquisition?

Key Canadian VC-Funded Biotechs with Trial Readouts in 2023

COMPANY: Prilenia

TRIAL TO WATCH IN 2023: The results of Prilenia’s Ph3 study evaluating the efficacy and safety of oral drug pridopidine in patients with early stages of Huntington’s disease (HD) is anticipated in March 2023

WHY IT’S IMPORTANT:

Prilenia was founded in 2018 by renowned scientist Michael Hayden from the University of British Columbia, who has also co-founded several other biotech companies, including NeuroVir Therapeutics, Xenon Pharmaceuticals, and Aspreva Pharma. Prilenia has raised $143.4M to date with Amplitude Ventures contributing to Prilenia’s $53M Series B raise in April 2022.

Lundbeck’s Xenazine (tetrabenazine) and Teva Pharmaceutical’s Austedo (deutetrabenazine) Pharmaceuticals were approved in 2008 and 2017, respectively, and the vesicular monoamine transporter 2 inhibitors are the only FDA-approved drug treatments for chorea (abnormal involuntary movements) associated with HD. While Austedo was FDA approved based on pivotal trials results showing an improvement in motor function (e.g., chorea) following 12 weeks of drug treatment, pridopidine has the potential to have a broader impact on patient QoL beyond only motor function.

The sigma-1 receptor target MoA of pridopidine differs from Xenazine and Austedo which are vesicular monoamine transporter 2 (VMAT2) inhibitors that limit synaptic monoamine uptake to promote motor function. Phase 2 results showed the drug significantly improved total function capacity (e.g., ability to manage work, daily living, and self-care) during a longer 26-week trial. Based on stronger efficacy results in the Phase 2 trial, the ongoing Phase 3 trial of pridopidine has been limited to early HD patients and the trial duration has been extended to 65 weeks.

In terms of the competitive pipeline, there are two additional drugs undergoing Phase 3 trials in HD including Roche’s tominersen, an mHTT mRNA targeting antisense oligonucleotide, and Neuroscience Biosciences Ingrezza (VMT2 inhibitor with a similar MOA to Austedo). Notably, uniQure received a 3mon pause of their Ph1/2 trial on an AAV-based miRNA approach (AMT-130) to inhibit the production of the mHTT protein by the FDA after safety concerns emerged, but the pause was lifted, and the trial resumed in November 2022. If approved, uniQure’s gene therapy would be considered the first and only disease-modifying therapy in HD. Analyst projections suggest the yearly revenue of AMT-130 could far exceed that of Xenazine and Austedo and reach $660M five years post-launch.

COMPANY: Eupraxia Pharmaceuticals

TRIAL TO WATCH IN 2023: Results from Eupraxia’s Ph2 study evaluating the safety and efficacy of EP-104IAR for 24 weeks in patients with osteoarthritis of the knee is expected in March 2023

WHY IT’S IMPORTANT:

Eupraxia Pharmaceuticals is headquartered in Victoria, British Columbia, and received early support from adMare BioInnovations before raising $32M from an IPO on the Toronto Stock Exchange in June 2019. Eupraxia’s lead asset EP-104IAR is in development for knee osteoarthritis, which is experienced by approximately ~30M individuals in the US. Current therapies are plagued by poor safety, inadequate efficacy, and limited duration of activity. Corticosteroids are one of only two drug classes strongly recommended by the American College of Rheumatology for the treatment of knee OA pain; these anti-inflammatory drugs are very effective at reducing pain for a short duration but can expose the body to local and systemic side effects.

There is a substantial clinical unmet need and commercial potential for efficacious non-opioid approaches to pain management. Flexion’s extended-release steroid injection, Zilretta, was approved in 2017 for knee osteoarthritis and the treatment regimen requires patients to receive injections every three months. In Oct 2021, Pacira BioSciences purchased Flexion for $8.50 a share or an equity value of ~$450M ($630M when including debt). In the year of acquisition, Zilretta had generated ~$100M in annual sales and is estimated to exceed $300M in revenue by 2028.

Eupraxia’s EP-104IAR is a long-acting formulation of the corticosteroid, fluticasone propionate, that is encapsulated by a microns-thin polymer membrane and is intended to slowly release the drug at therapeutic concentrations for up to six months. The drug may someday warrant similar value of Zilretta as it has the potential dual advantage of providing long-duration pain relief with fewer side effects while improving patient satisfaction from reduced injection frequency.

COMPANY: Repare Therapeutics

TRIAL TO WATCH IN 2023: Results of a Phase 1b/2 Study of ATR InhibiTor RP-3500 and PARP Inhibitor Combinations in Patients with Molecularly Selected Cancers (ATTACC) has an anticipated completion of October 2023

WHY IT’S IMPORTANT:

When the Quebec-based Repare Therapeutics raised $253M in its initial public offering on the Nasdaq Stock Exchange in June 2020, it was the largest ever for a Canadian biotech company. The company also received development capital on the same date from Amplitude Ventures which had previously participated in the $68M Series A (June 2017) and $82.5M Series B (September 2019) financing rounds. Two years post-IPO, Repare signed a worldwide licensing agreement with Roche for the development and commercialization of their lead clinical-stage product candidate, RP-3500 (camonsertib), a potent and selective oral small molecule inhibitor of ATR that is being developed for the treatment of tumors with specific synthetic-lethal genetic mutations in ATM gene. The deal value included $125M of upfront payments and up to $1.2B in milestone payments. In addition to the lead Phase 1b/2trial of RP-3500 in combination to PARP inhibitors (Olaparib/niraparib) or talazoparib, Repare is developing the drug in combination with gemcitabine and as a monotherapy, however these trials had not been initiated.

The long-term utilization of RP-3500 in these advanced patients may be as combination regiment with PARP inhibitors based on preliminary results and the less optimistic perception by key opinion leaders about the potential of RP-3500 as a monotherapy4. Moreover, physicians are encouraged by the potential for the use of circulating tumor DNA-based liquid biopsies to predict higher RP-3500 response.

Other Canadian VC-Funded Biotechs with 2023 Clinical Trial Completions

Lumira Ventures

-

G1 Therapeutics: A Randomized, Double-blind, Placebo-controlled, Phase III Clinical Trial of GB491 Combined with Fulvestrant in Subjects With HR+, HER2- Locally Advanced or Metastatic Breast Cancer Who Have Progressed on Prior Endocrine Therapy (Expected Completion: Oct 2023)

-

Antiva Biosciences: An Open-Label Single and Multiple-dose, Study to Evaluate Safety, Tolerability and Efficacy of ABI-2280 Vaginal Tablet in Participants with Cervical Squamous Intraepithelial Lesions (Expected Completion: July 2023)

CTI Life Sciences Fund

-

VectivBio: A multicenter, double-blind, randomized, placebo-controlled trial to evaluate the efficacy and safety of apraglutide in adult subjects with short bowel syndrome and intestinal failure (SBS-IF) (Expected Completion: June 2023, Results expected Dec 2023)

Quark Venture

-

Eloxx Pharma: A Phase II Open-Label Pilot Study to Evaluate The Safety And Efficacy Of Subcutaneously Administered ELX-02 In Patients With Alport Syndrome With Col4A5 And Col4A3/4 Nonsense Mutation (Expected Completion: May 2023)

REFERENCES

-

BioTalent Canada, Labour Market Intelligence – Close-up on the bio-economy, 2021 National Report

-

Pitchbook

-

S&P Capital IQ

-

Stifel Industry Update (Jan 2022): Stifel Biotech Doc Days, Synthetic lethality in DDR Panel Takeaways

Acknowledgement and thanks to Kyle Mak, Senior Analyst, Investment Banking, for supporting this research.